Mastering QuantConnect’s Algorithm Framework for Efficient Trading Strategy Development

Published:

QuantConnect is an innovative, browser-based platform designed for algorithmic trading. Whether you’re a seasoned quant or just beginning, QuantConnect offers a robust environment to develop, test, and execute trading strategies using modern programming languages like Python and C#. The platform’s intuitive interface and vast data resources make it a go-to choice for traders at all levels.

QuantConnect provides access to terabytes of free financial data, allowing users to backtest and execute live trades across various asset classes, including Equities, Futures, Options, Forex, CFD, and Cryptocurrencies. The platform seamlessly integrates the entire trading process, from idea to live strategy deployment, making it a comprehensive tool for any trading professional.

Beyond its core functionalities, QuantConnect boasts several advanced features like the Strategy Development Framework and Alpha Stream. These tools allow you to leverage pre-built modules to design sophisticated trading strategies and even monetize them by leasing out your algorithms to third parties without revealing your proprietary code.

What Does QuantConnect Offer?

Backtesting and Live Trading

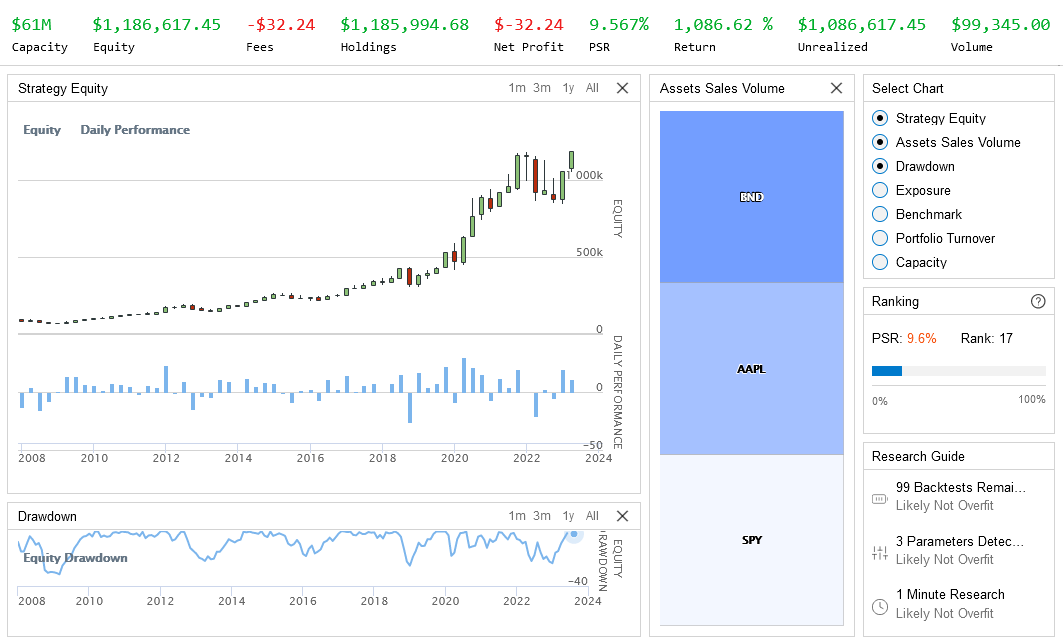

QuantConnect stands out from other platforms with its easy-to-use backtesting feature. With just a few clicks, you can configure your backtest parameters—such as the start and end dates, and the initial capital—and let the platform do the rest. The backtest results are presented through comprehensive statistics and graphs, helping you refine your strategies with confidence.

While backtesting is free, live trading on QuantConnect requires a small monthly investment: $8 for a Quant Researcher membership and $20 for the smallest live trading node.

Paper Trading

QuantConnect offers a fantastic “paper trading” feature, allowing you to test your strategies using simulated money. This is particularly useful for beginners or when trying out a new strategy, as it provides real-time market data without risking actual capital. You can select paper trading during the “Select Brokerage” step in the Go Live flow.

Free Data

A significant advantage of using QuantConnect is the access to a vast amount of free data through the QuantConnect Data Explorer. While this data is free to use within the platform’s IDE, be aware that downloading the data for external use may incur a fee.

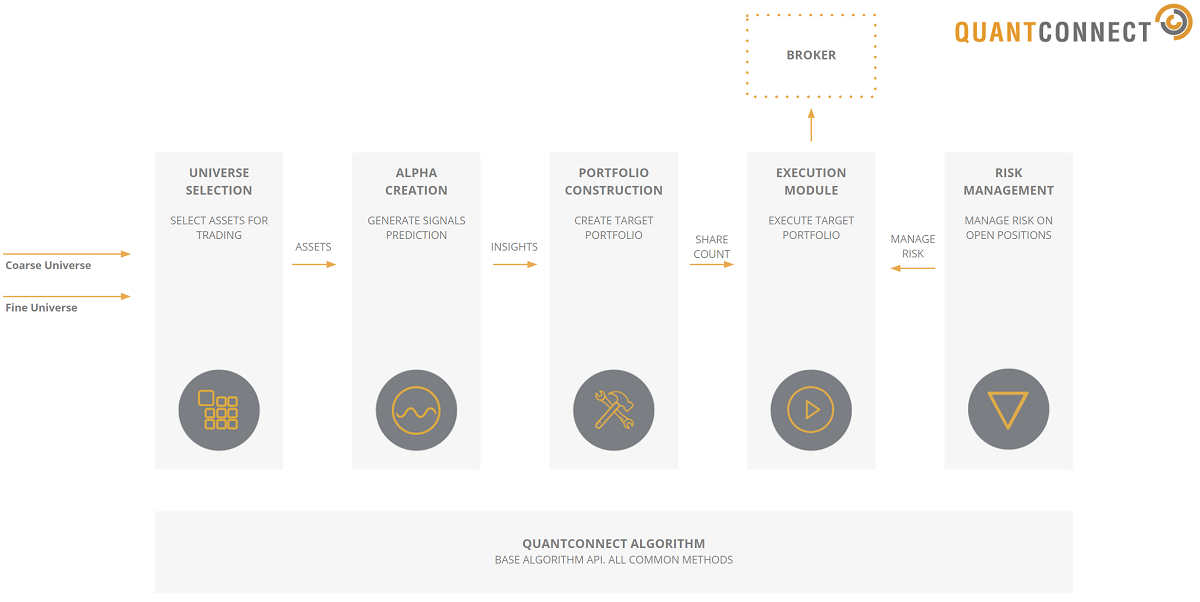

Strategy Development Framework

QuantConnect’s Strategy Development Framework (SDF) is a powerful set of plug-and-play modules designed to simplify the creation and management of complex trading strategies. The framework is divided into five key sections:

- Alpha Creation: Algorithms generate insights about market trends, predicting the direction, magnitude, and confidence of asset movements.

- Universe Selection: Filters and selects assets for trading based on metrics like liquidity, volatility, and market capitalization.

- Portfolio Construction: Determines the allocation of funds across selected assets.

- Execution: Implements trades based on the portfolio’s target allocations.

- Risk Management: Manages and mitigates risks, such as cutting losing positions early.

These sections interact seamlessly, creating a cohesive strategy development process.

Building a Simple Portfolio Management Algorithm

To harness the full potential of QuantConnect, let’s explore how to build a simple portfolio management algorithm using the pre-built modules within the Strategy Development Framework. This will give you an overview of how the framework operates, after which you can start customizing your modules to meet specific needs.

How to Use the Algorithm Framework

The Algorithm Framework is integrated directly into the QCAlgorithm class, so you can build upon existing methods without needing a separate class. Here’s a basic structure to get you started:

class MyFrameworkAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_universe_selection(ETFConstituentsUniverseSelectionModel("SPY"))

self.add_alpha(RsiAlphaModel())

self.set_portfolio_construction(EqualWeightingPortfolioConstructionModel())

self.set_execution(ImmediateExecutionModel())

self.add_risk_management(NullRiskManagementModel())

1. Universe Selection Module

The Universe Selection module filters a universe of assets and returns a list of Symbol objects for your strategy. This list is crucial because it defines the scope of your trading strategy, ensuring that you’re targeting the right assets—whether simple equities or complex instruments like futures and options.

In our example, we’re using the ETFConstituentsUniverseSelectionModel("SPY"), which dynamically selects the top 500 companies in the S&P 500 index. This model adapts automatically to any changes in the index’s constituents.

Here’s an example of filtering this universe further to select only the top 10 constituents by weight:

def initialize(self) -> None:

self.universe_settings.asynchronous = True

self.add_universe_selection(

ETFConstituentsUniverseSelectionModel("SPY", universe_filter_func=self._etf_constituents_filter)

)

def _etf_constituents_filter(self, constituents: List[ETFConstituentUniverse]) -> List[Symbol]:

selected = sorted(

[c for c in constituents if c.weight],

key=lambda c: c.weight, reverse=True

)[:10]

return [c.symbol for c in selected]

2. Alpha Module

The Alpha model generates market insights, signaling the best times to trade. These Insight objects include predictions about the direction, magnitude, and confidence of asset price movements. In this example, we use the RsiAlphaModel, which generates insights based on the RSI indicator, signaling buy or sell actions based on overbought or oversold conditions.

3. Portfolio Construction Module

The Portfolio Construction module converts these insights into PortfolioTarget objects, which define how much of each asset should be held. The EqualWeightingPortfolioConstructionModel used here ensures that each asset with an active insight receives an equal share of the portfolio.

4. Risk Management Module

Risk Management is critical in any trading strategy. Here, the NullRiskManagementModel is used, which doesn’t adjust any portfolio targets, serving as a placeholder until a more sophisticated risk management strategy is implemented.

5. Execution Module

Finally, the Execution module places trades in the market to meet the portfolio targets. The ImmediateExecutionModel is used in this example to execute trades immediately using market orders, aligning the portfolio with the targets determined by the previous modules.

Customizing and Expanding Your Strategy

The true power of the QuantConnect Algorithm Framework lies in its modular design, allowing you to tailor each component to fit your specific strategy needs. Whether you’re managing a simple portfolio or developing a complex multi-asset strategy, the framework’s flexibility makes it easier to manage, test, and refine your algorithm.

As your strategy evolves, you can update individual modules without affecting the overall structure. This modular approach is invaluable when managing complex strategies with intricate logic, ensuring that you can scale and adapt as market conditions change.

Summary

QuantConnect is a versatile and powerful platform that provides all the tools needed to develop, backtest, and execute algorithmic trading strategies. By leveraging the Strategy Development Framework, you can streamline your strategy development process, making it more efficient and adaptable.

Whether you’re a beginner looking to explore algorithmic trading or an experienced quant aiming to refine your strategies, QuantConnect offers a comprehensive environment that supports every step of your journey. Start experimenting with the pre-built modules today, and unlock the full potential of algorithmic trading on QuantConnect.